بازار بورس وال استریت - A Financial Outlook

Imagine, if you will, a grand, bustling place, a kind of central gathering spot where different kinds of value are exchanged, a vibrant center of activity where people come to find opportunities and make connections. This, in a way, describes what many think of when they consider Wall Street, a name that, you know, often brings to mind a very particular kind of energy and movement. It's a place, or rather, a concept representing the heart of a vast financial system, where fortunes can shift and new paths can appear, sometimes quite quickly. People from all walks of life, from seasoned professionals to everyday folks just starting out, often look to this area for possibilities, for growth, and for a chance to put their money to work in ways they might not have thought possible before.

This financial hub, which is Wall Street, functions a bit like a very large market, where, basically, instead of physical goods, things like company shares, bonds, and other financial tools are bought and sold. It's a place where businesses seek money to grow, and individuals or groups put their savings into these businesses, hoping to see them thrive and, in turn, increase their own wealth. It’s a dynamic environment, always changing, always reacting to world events, and it really does shape a great deal of what happens in the broader economy. So, too, it's almost a living thing, responding to news and expectations, making it a truly captivating subject for many.

It’s worth noting that while we talk about "Wall Street" as a single place, it’s really more of an idea, a collection of financial institutions and exchanges that work together to create this huge marketplace. Just as a popular online market for applications and games, like the one many people use on their phones, offers a wide array of digital items for every taste and need, Wall Street presents a similar breadth of financial instruments. There are, for instance, ways to invest in big, well-known companies, or perhaps smaller, newer ventures, offering a variety of choices for anyone looking to participate.

Table of Contents

- A Grand Financial Bazaar

- What Kinds of Opportunities Does This بازار بورس وال استریت Offer?

- Getting Your Foot in the Door

- How Do We Stay Up-to-Date with the بازار بورس وال استریت?

- Keeping Things Secure

- Are There Different Flavors of بازار بورس وال استریت Investments?

- The Heartbeat of the Economy

- What Might the Future Hold for the بازار بورس وال استریت?

A Grand Financial Bazaar

Think of Wall Street, really, as a kind of very big, very active bazaar, a place where, like, many different kinds of financial goods are bought and sold. It’s not just one building or one street corner, but rather a whole network of people and systems working together. This central hub, you know, acts as a meeting point for those who have money they wish to grow and those who need money to expand their businesses or create new things. It’s a constant flow, a back and forth, that keeps the financial engines of many nations turning. In some respects, it’s a lot like a bustling public square, full of different voices and different aims, all contributing to a larger purpose.

This financial marketplace, so to speak, is where companies, both very large and quite small, offer pieces of themselves to the public. These pieces, often called shares, allow regular people to own a small part of a business. When you buy a share, you’re essentially saying, “I believe in this company, and I want to be a part of its success.” It’s a direct way for individuals to put their belief into action, and, like your, watch their chosen businesses grow, hopefully bringing them a return on their initial contribution. It’s a fascinating setup, honestly, where trust and expectation play very big roles.

The sheer volume of activity here is something to consider. Every day, countless transactions happen, with money moving between different hands and different ventures. It’s a reflection of human ambition and the desire for progress, as companies seek funds for new ideas and people seek ways to make their money work harder for them. This constant movement, you know, is what gives Wall Street its reputation for being a place of both great opportunity and, sometimes, quite a bit of excitement. It’s a place where the collective hopes and dreams of many individuals and businesses play out on a very large stage.

- Frank And Son Collectible Show

- Polly Princess

- Ka Moana Luau

- Mr Shrimp New Jersey

- Ikea Customer Service Number

What Kinds of Opportunities Does This بازار بورس وال استریت Offer?

When you think about this **بازار بورس وال استریت**, you might wonder, what sorts of things can one actually get involved with there? Well, it’s a bit like a very comprehensive digital store, say, for mobile applications, where you find all sorts of categories and choices. Just as you might browse for, perhaps, a new game, or maybe a tool to help you with daily tasks, this financial market offers a similar breadth of options. You could, for instance, choose to invest in shares of a technology company, or perhaps a business that makes everyday goods, or even something in the energy sector. There’s a very wide selection, really.

It’s not just about buying parts of companies, either. This financial market also has places for other kinds of things, like bonds, which are essentially loans you give to a government or a company, and they promise to pay you back with a bit extra over time. Then there are mutual funds, which are like collections of different investments put together by experts, making it easier for people to spread their money around without having to pick each item themselves. So, you know, it’s quite varied, offering different ways to approach putting your money to work, depending on what you’re hoping to achieve and how much risk you feel comfortable with.

The range of possibilities here means that there’s often something for nearly everyone, from those who prefer a more cautious approach to those who are comfortable with taking on a bit more risk for the chance of bigger returns. It’s about finding the right fit for your personal aims and, like your, comfort level. This variety, honestly, is one of the key features that makes the financial market so appealing to so many people looking to build something for their future. It's a place where, in a way, you can tailor your approach to your own unique situation.

Getting Your Foot in the Door

So, how does one, say, actually get involved with this whole financial market thing? It’s probably simpler than some might imagine, honestly. Just like getting access to a vast collection of mobile applications and games, where you might just need to download a particular store, getting into the financial world often starts with opening an account with a brokerage firm. These firms act as your gateway, allowing you to buy and sell the various financial items that trade on Wall Street. They provide the tools and the connection points you need to make your moves.

It used to be that you needed a lot of money to even think about participating, but that’s really changed over time. Now, with the help of various online platforms and services, it’s much more accessible for people who might only have a smaller amount to start with. This means that, basically, more individuals can try their hand at investing, learning as they go. It’s a shift that has, in a way, democratized access to what was once a more exclusive area, allowing a wider range of people to get a feel for how these markets operate and perhaps benefit from them.

The first step, really, is usually about doing a little bit of homework. Understanding what you’re getting into, even just a little, can make a very big difference. It’s about figuring out what your aims are, how much you might be able to put in, and what kind of risks you’re okay with. Then, finding a suitable brokerage that fits your needs is the next logical move. It’s a straightforward process for the most part, but, you know, taking it one step at a time can help make it feel less overwhelming for someone just starting out.

How Do We Stay Up-to-Date with the بازار بورس وال استریت?

Given how quickly things can change in this **بازار بورس وال استریت**, a question that often comes up is, how do people manage to stay current with everything? It’s a bit like how your phone applications get regular updates, keeping them fresh and working well. The financial markets also have a constant stream of new information, news, and reports that can influence what happens. Staying informed is, like, pretty important for anyone involved.

There are, for instance, many ways to keep an eye on what’s going on. Financial news outlets, both on television and online, provide constant coverage. There are also specialized websites and services that give you real-time information about prices and trends. Many brokerage firms, too, offer their clients research and analysis to help them make sense of the daily happenings. It’s a continuous learning process, really, where paying attention to what’s happening in the world can give you a better sense of where things might be headed.

It’s not just about watching numbers go up and down, either. Staying current also involves understanding broader economic trends, global events, and even things like new inventions or changes in how people live their lives. All these factors, you know, can play a part in how companies perform and, consequently, how their shares might fare. So, it’s about having a curious mind and being willing to absorb information from many different sources, always looking for those little clues that might point to something bigger.

Keeping Things Secure

When you’re dealing with something as important as your money, the idea of keeping things safe is, honestly, at the top of everyone’s mind. Just like a good app store has a "security shield" to make sure the applications you download are safe and sound, the financial world also has many layers designed to protect people’s contributions. There are rules and regulations put in place by various government bodies to oversee how financial firms operate, making sure they play by the rules and act in their clients’ best interests.

These protections are, basically, meant to give people peace of mind. For example, many countries have systems in place that protect a certain amount of your money in case a brokerage firm runs into trouble. This is a bit like having an insurance policy for your financial accounts. It means that even if something unexpected happens to the firm you’re working with, your money is still protected up to a certain limit. This kind of safeguard is, like, a very important part of building trust in the system.

Beyond these official protections, individuals also play a part in keeping their own financial dealings secure. This means being careful with your personal information, using strong passwords, and being aware of potential scams. It’s about being a bit watchful and, you know, taking sensible steps to protect yourself. The financial system is designed with safety in mind, but personal vigilance adds an extra layer of protection, ensuring that your journey in the market is as smooth and worry-free as possible.

Are There Different Flavors of بازار بورس وال استریت Investments?

Thinking about this **بازار بورس وال استریت**, you might ask, are all the opportunities the same, or are there, like, different kinds to pick from? It’s very much like how a popular app store offers both local applications made specifically for users in a certain region and also global ones that are popular everywhere. The financial market also has its own versions of "local" and "foreign" opportunities, offering a wide array of choices for people looking to put their money to work.

You can, for instance, choose to focus on companies that are based right in your own country, businesses you might be very familiar with because you see their products or services every day. This is often called domestic investing. It can feel a bit more comfortable for some, as they might have a better sense of the local economy and what makes these companies tick. It’s a way to support businesses close to home and, you know, potentially benefit from their growth within your own economic landscape.

On the other hand, there’s also the option to look beyond your own borders and invest in companies that are based in other parts of the world. This is often referred to as international investing. It can open up a whole new set of possibilities, allowing you to participate in the growth of economies that might be expanding very quickly, or to invest in companies that offer products or services not readily available in your own country. It’s a way to spread your money across different regions and, in a way, benefit from a broader range of global trends and innovations.

Both approaches have their own particular characteristics, and many people choose to do a bit of both, mixing domestic and international opportunities to create a more varied collection of investments. This blend, basically, helps to manage risk and potentially capture growth from different corners of the world. So, yes, there are definitely different "flavors" to pick from, allowing you to tailor your approach to what feels right for you and your aims.

The Heartbeat of the Economy

It’s pretty clear that Wall Street, or rather the financial markets it represents, acts as a very important part of the overall economy. You could say it’s a bit like the main engine or the central pump that keeps money flowing through the system. When businesses need money to build new factories, hire more people, or come up with new ideas, they often turn to these markets to get the funds they need. This process, in turn, helps create jobs, sparks innovation, and contributes to the overall health and growth of a country’s economy.

The way this market works also gives us a kind of reading on how well things are going. When companies are doing well and people feel good about the future, you often see more activity and higher values in the market. Conversely, when there’s uncertainty or economic challenges, things can slow down. So, in a way, the daily movements on Wall Street can give us clues about the bigger economic picture, acting as a kind of barometer for collective confidence and future expectations. It’s a very sensitive indicator, honestly, reacting to all sorts of news and events.

This constant interaction between businesses seeking money and individuals providing it creates a cycle that fuels progress. It allows for the big projects to get off the ground, the new technologies to be developed, and the services that make our lives better to become available. It’s a powerful force, really, that plays a very big part in shaping the world we live in and, you know, how quickly societies can move forward. It’s a system that, for all its complexities, serves a rather simple, yet incredibly important, purpose: connecting capital with opportunity.

What Might the Future Hold for the بازار بورس وال استریت?

Looking ahead, one might wonder, what’s next for this **بازار بورس وال استریت**? Just as mobile applications and digital services are always getting newer features and becoming more integrated into our lives, the financial markets are also constantly evolving. We’re seeing, for instance, new technologies like artificial intelligence and advanced data analysis starting to play a much bigger role in how decisions are made and how trades are carried out. These tools are, basically, changing the game for many who work in this area.

There’s also a growing focus on things like sustainable investing, where people are looking to put their money into companies that are not only financially sound but also do good for the planet and society. This trend suggests a shift in values, where more people are considering the broader impact of their money, not just the potential returns. It’s a very interesting development, honestly, that could reshape how companies are viewed and how investment choices are made in the years to come.

The accessibility of these markets is also likely to continue to grow. As more people around the world gain access to digital tools and financial education, it’s quite possible that even more individuals will feel comfortable participating. This broader involvement could, you know, lead to even more diverse ideas and perspectives influencing the market, making it an even more dynamic and representative reflection of global economic activity. So, the future of this big financial bazaar seems poised for continued change and, very likely, even greater connectivity.

- The Geffen Contemporary At Moca

- Landmark Pasadena Playhouse

- Incredible Tiny Homes

- Walmart Auburn Maine

- The Dress Outlet

برنامههای جدید بورس برای سال 1403+ جزئیات

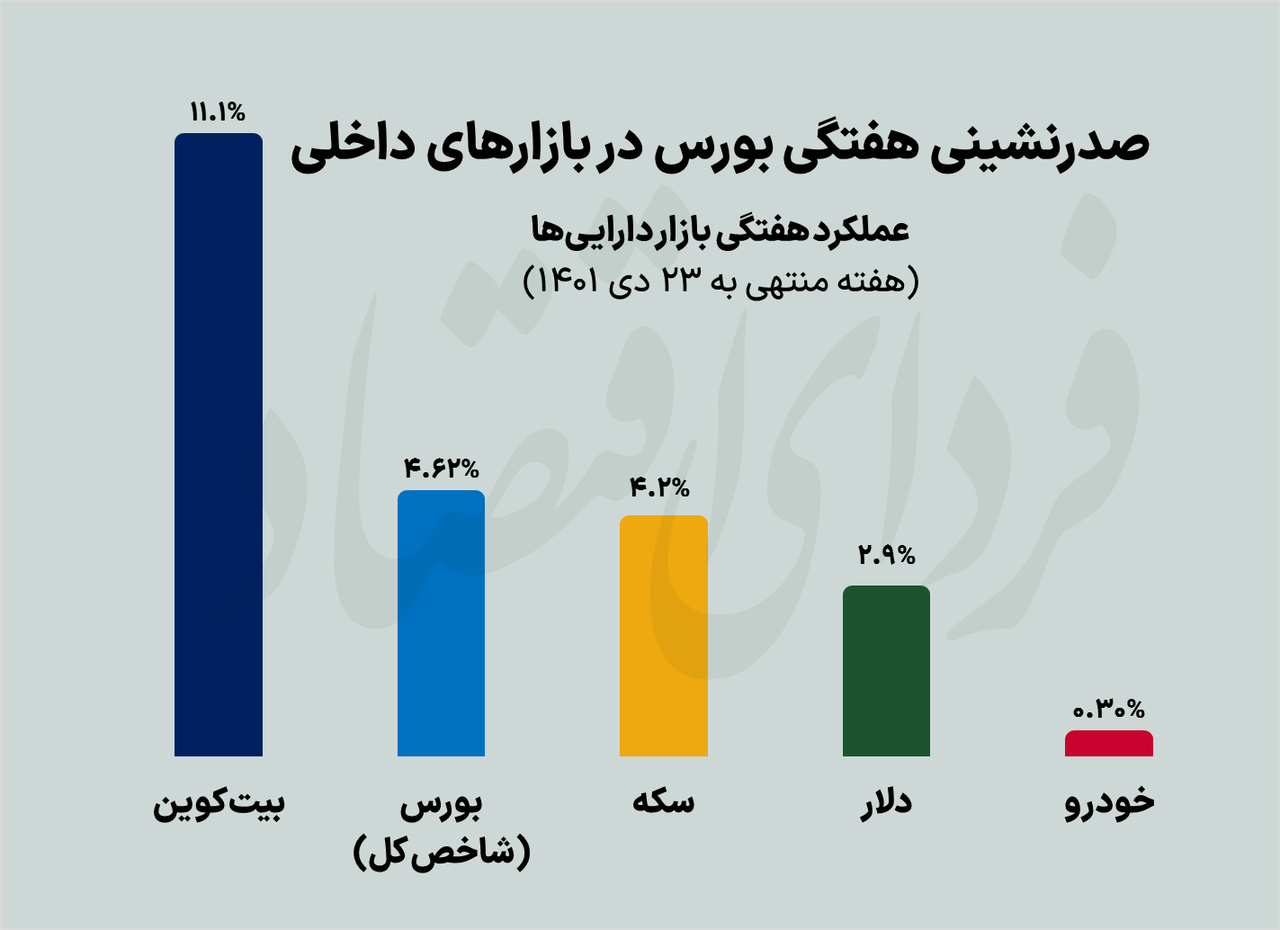

بورس برنده بازارهای داخلی شد

فراز و فرود ارزش معاملات بورس در هفته صعودی بازار