Harris County Appraisal - Your Home Value Guide

For anyone who owns a home in Harris County, figuring out how your property's value gets set for tax purposes can feel a bit like trying to solve a puzzle. This whole process, managed by the Harris County Appraisal District, or HCAD, is actually pretty important because it affects how much you pay in property taxes each year. It's almost something every homeowner needs to keep an eye on, so you know exactly where you stand with your home's worth.

You see, there are some pretty big changes coming for how Texas homestead exemptions work, especially for homes in Northwest Houston, and that's for 2025. It's not just about the big picture, though; little things, like how easy it is to use the HCAD app on your phone, can actually make a real difference in how you manage your property details. So, people are sharing some really helpful thoughts and tips about this, and you can actually join in the conversation right now.

Whether you're trying to figure out how to get your homestead exemption filed in Harris County, or maybe you're just trying to check if the information about your home is right on their records, there are ways to make it all a bit smoother. We'll be looking at some of the common things people wonder about, like what happens to your tax assessment when you sell your home, or how to get help from real estate agents with all this stuff. It's all about making sense of your property's value, basically.

- Glenn Cambre Lawyer

- Brickhouse Nutrition

- Marcus Hillside Cinema

- Marcus Rosemount Cinema

- Mercedes Stevens Creek

Table of Contents

- What Does HCAD Harris County Appraisal Really Do?

- Key Changes to Texas Homestead Exemptions in 2025 - What You Should Know

- Is Your Property Information Accurate with HCAD Harris County Appraisal?

- Does a Property Sale Reset Your Tax Assessment in Harris County?

- Protesting Your Property Value - The May 16th Deadline Approaches

- Finding Your Way - Where Can I Locate HCAD Harris County Appraisal Neighborhood Maps?

- The Role of Real Estate Agents in Your HCAD Harris County Appraisal Journey

- The True Purpose of Your HCAD Harris County Appraisal Value

What Does HCAD Harris County Appraisal Really Do?

You might hear the name HCAD quite a bit if you live in Harris County, and you know, it’s really the organization that looks at every piece of property in the county. Their main job is to figure out how much each home, business, or piece of land is worth. This value, basically, is what the local taxing units, like your city or school district, use to decide how much property tax you owe. So, it's pretty important for your wallet, actually. They are the ones who put a number on your home's worth for tax purposes, and that number can definitely change over time, sometimes quite a lot.

The Core Job of the Harris County Appraisal District

The Harris County Appraisal District has this big responsibility of presenting information on their website, and you know, it's meant to be a helpful service for everyone. They are essentially the official source for property values in the area. What they do is, they assess properties so that local governments can collect the taxes needed to run schools, keep up roads, and provide other public services. It’s a huge task, and they are, in a way, the central point for all property valuation data in the county. They are really just trying to make sure everyone's property is valued fairly for tax collection, or so they say.

Key Changes to Texas Homestead Exemptions in 2025 - What You Should Know

There are some rather significant updates coming for homestead exemptions in Texas, particularly for homes in the Northwest Houston area, and these changes are set to begin in 2025. A homestead exemption can really help lower the taxable value of your home, which means you pay less in property taxes. It's a benefit for homeowners that many people don't fully understand or even know about. Staying on top of these changes is a good idea because they could definitely affect your annual tax bill, sometimes quite a bit.

Using the HCAD App for Harris County Appraisal Exemptions

You know, one of the easiest ways to handle things like filing for a homestead exemption in Harris County is by using the Harris County Appraisal District's app. It’s pretty convenient, honestly. If you're a buyer, or even if you just own a home in Harris County, you can apparently get this done right from your couch, anytime you want. This app makes the whole process of applying for an exemption much less of a headache than it used to be. It's kind of a modern solution for a somewhat traditional process, which is nice, to be honest.

Is Your Property Information Accurate with HCAD Harris County Appraisal?

It’s really important to make sure the details about your property on file with the Harris County Appraisal District are correct. Sometimes, you might find something that just doesn't seem right, like a wrong square footage or an incorrect number of bedrooms. You know, these little errors can actually have a pretty big impact on how your property is valued, and consequently, on how much you pay in taxes. So, checking this information regularly is a very good habit to get into, basically.

How to Address Incorrect Details on Your Harris County Appraisal District Record

If you happen to spot some discrepancies in the information on your property deed or other official papers when you compare them to what HCAD has, it’s a good idea to act on it. You can check the information on your property deed or other official documents to confirm these differences. Then, you should probably get in touch with the Harris County Appraisal District. They are the ones who can help you sort out these issues and make sure your record is updated to reflect the correct details. It's their job, after all, to keep accurate records, so they should be able to help you get it fixed, you know.

Does a Property Sale Reset Your Tax Assessment in Harris County?

This is a question many people wonder about, especially when they are buying or selling a home: does selling a property mean that its assessment for taxes just starts all over again? It’s a pretty common concern, and it has some pros and cons, depending on your situation. The way property values are assessed for tax purposes can be a little different from the actual market price you pay for a home, and this can lead to some confusion. Understanding this point is, in a way, pretty helpful for planning your finances around a home purchase or sale.

Understanding the Impact on Your Harris County Appraisal District Value

When a property changes hands, the Harris County Appraisal District will, of course, look at the property again. They use market data, recent sales in the area, and the property's characteristics to set its new appraised value for tax purposes. This doesn't always mean it "resets" in the way you might think, but rather, the sale price can definitely influence their new valuation. It's worth exploring the pros and cons of whether a property sale truly resets the assessment for taxes, because it's not always as simple as it sounds, actually.

Protesting Your Property Value - The May 16th Deadline Approaches

For residents of Harris County, there's typically a deadline each year to file a protest if you disagree with the property appraisal value set by the Harris County Appraisal District. This year, the deadline is May 16th, so it’s something you definitely want to keep in mind if you think your home's value is too high. You have options for how to do this, which is pretty convenient. You can send in a paper notice, or you can use HCAD's online system, which many people find easier, to be honest.

Filing Your Harris County Appraisal Protest Online

Using HCAD’s online system to protest your property appraisal is a pretty straightforward way to get it done. It saves you the trouble of mailing things and waiting around. Many people find that using the online tools provided by the Harris County Appraisal District makes the whole protest process much more manageable. It’s a good option if you want to challenge your property's value without too much fuss. So, if you're thinking about protesting, the online method is definitely worth looking into, you know.

Finding Your Way - Where Can I Locate HCAD Harris County Appraisal Neighborhood Maps?

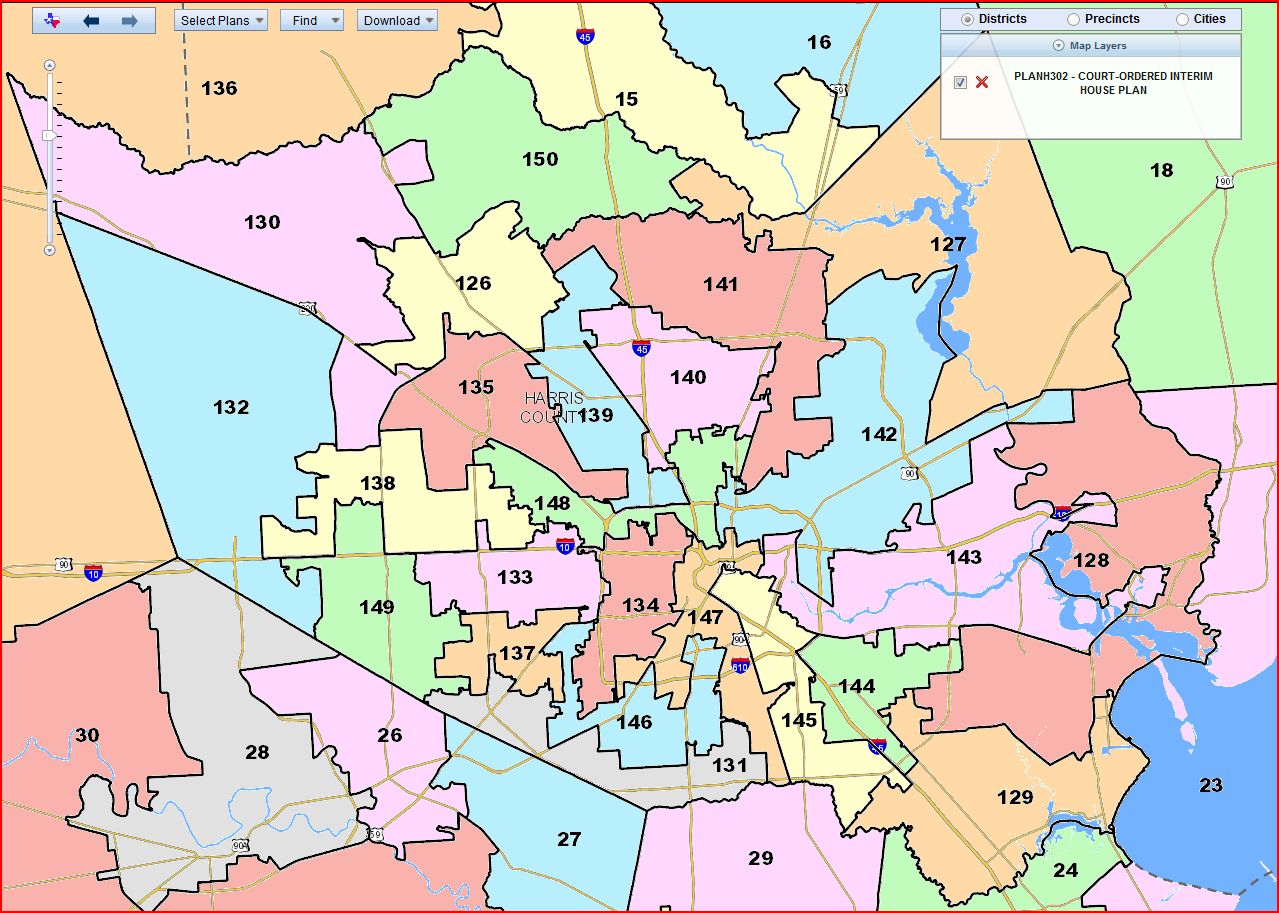

Sometimes, people want to see where their property fits into the larger picture of their neighborhood, especially as defined by the Harris County Appraisal District. They might wonder where they can get their hands on HCAD neighborhood maps. These maps can show you how HCAD groups properties together for appraisal purposes, which can be interesting if you're trying to understand how they value homes in your specific area. It’s a pretty common question, as a matter of fact, for those wanting to dig a little deeper into the appraisal process.

Accessing Information from the Harris County Appraisal District

If you're looking for things like HCAD neighborhood maps, or any other kind of detailed information about property values, the Harris County Appraisal District is usually the place to go. They present a lot of information on their website as a public service. While they might not always guarantee the accuracy of every single piece of data, they are the primary source for this kind of material. So, if you need to locate or obtain any specific details related to your property's appraisal or neighborhood classifications, their website or direct contact is where you'd typically start, basically.

The Role of Real Estate Agents in Your HCAD Harris County Appraisal Journey

When you're dealing with property values and taxes, especially those set by the Harris County Appraisal District, getting some guidance can be really helpful. This is where real estate agents often come into play. They are usually pretty familiar with how HCAD works and can offer some useful advice, whether you're buying, selling, or just trying to understand your property's assessment. They are, in a way, a good resource for many people who find this whole area a bit confusing.

Getting Expert Advice on Harris County Appraisal District Matters

Real estate agents can provide a lot of insight when it comes to understanding your Harris County Appraisal District assessment. They often have a good sense of local market values and can sometimes help you spot if your appraisal seems off. They can also offer guidance on things like tax exemptions or how a property sale might affect future assessments. So, if you're feeling a little lost about your property's value or how to deal with HCAD, talking to a real estate agent could be a very smart move, you know.

The True Purpose of Your HCAD Harris County Appraisal Value

It's important to remember what the value set by the Harris County Appraisal District is actually used for. This number, the one they give your property, has one main purpose, and that's for collecting property taxes. It’s not necessarily what your home would sell for on the open market, or what a bank would lend you for it. It's solely for the purposes of collecting property taxes, which is a key point to understand about the HCAD valuation.

Why the Harris County Appraisal District Sets Your Property's Worth

The Harris County Appraisal District's value is, in essence, the starting point for your property tax bill. They make no warranty or guarantee concerning the accuracy or completeness of all the information on their website, but the value they assign is the official figure for tax calculations. So, while you might think your home is worth more or less, for tax purposes, the HCAD value is what counts. It’s pretty much the foundation upon which your annual property tax obligations are built, so it's a number that really matters to your finances.

This whole discussion has really been about understanding the Harris County Appraisal District, from how they value homes for tax purposes to the key changes coming for homestead exemptions in 2025, especially for homes in Northwest Houston. We've talked about how useful the HCAD app can be for filing exemptions and why it’s so important to check your property details for accuracy. We also looked at what happens to tax assessments when a property sells, and the crucial May 16th deadline for filing property appraisal protests, with options for using HCAD’s online tools. Plus, we touched on where to find HCAD neighborhood maps and how real estate agents can offer valuable guidance. Ultimately, the HCAD value is what determines your property taxes.

- Cfg Arena

- Puesto Mission Valley

- Great Wolf Lodge Williamsburg Va

- Great Wolf Lodge Lagrange Ga

- French Toast Heaven

Hcad Harris County Appraisal District 2025 - Colin Lewis

Harris County Appraisal District Extends Property Tax Filing Deadline

Harris County Appraisal District Hcad Budget | Tax Cutter