Dairyland Auto Insurance - Your Road Companion

Finding the right kind of protection for your vehicle, whether it has two wheels or four, can feel like a pretty big decision. You want something that just works, something you can count on, and something that doesn't break your bank account. For many years, people have looked to Dairyland for help with their vehicle insurance needs, and apparently, they have built up a good name for themselves over the past five decades. It’s a name that has been around a while, more than 50 years, and that kind of staying power might mean something to you when you are looking for a company to trust with your car or motorcycle.

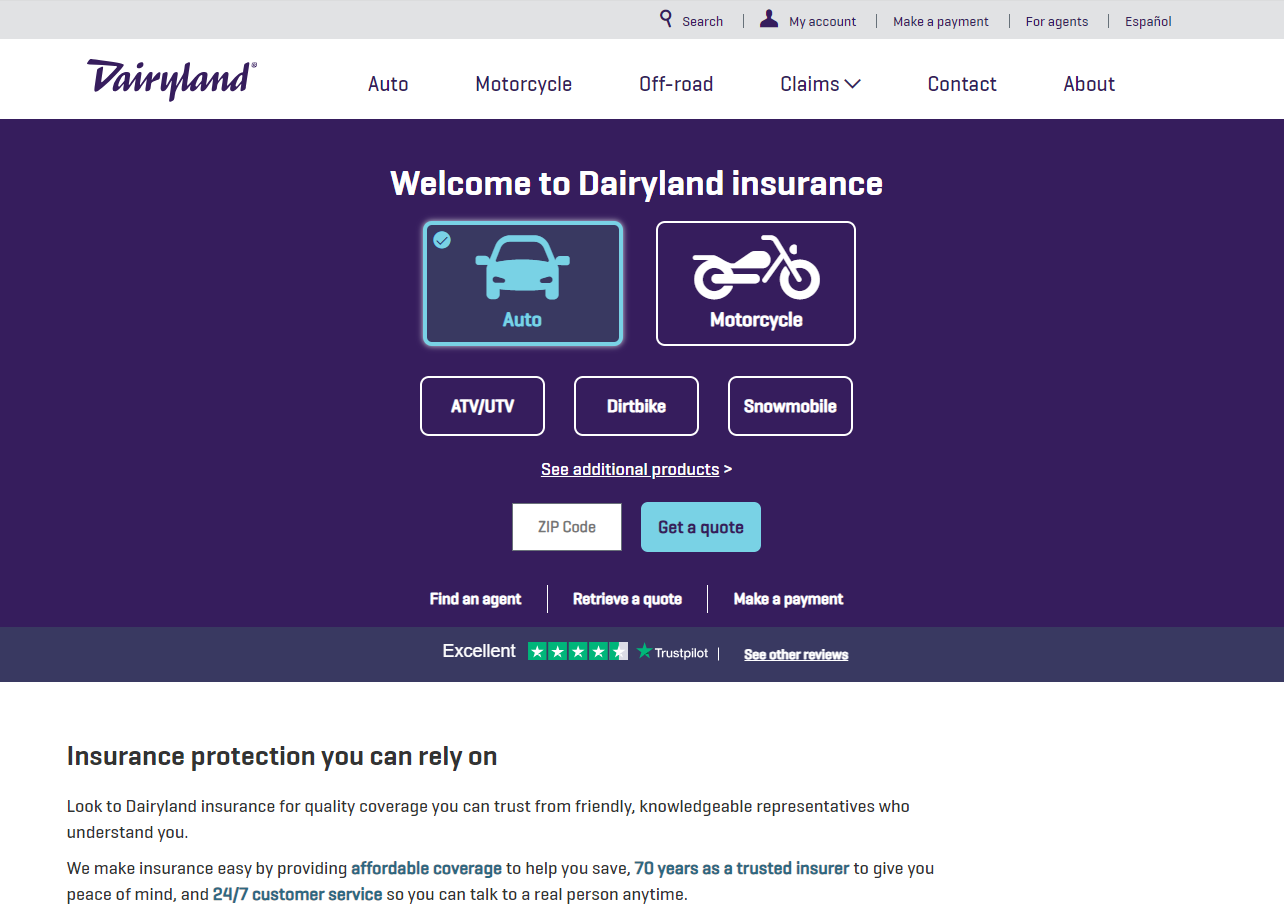

When you are thinking about vehicle protection, you often want to get an idea of what things might cost without a lot of fuss, right? Dairyland makes it pretty simple to get quick price estimates for both cars and motorcycles. You can usually get these estimates right from your computer or by making a quick phone call. This way, you can get a sense of what is available and how it might fit into your budget, just a little bit faster than you might expect. They offer various ways to get covered and even some ways to help you keep costs down, which is something many people look for, obviously.

It's all about making things easier for you, so it seems. From getting your first estimate to actually paying for your protection, Dairyland tries to keep things straightforward. They want you to find the kind of coverage that makes sense for you, at a price that feels comfortable to pay. And when it comes to managing your account, like paying your bills, they try to make that pretty easy too, giving you options to handle things whenever and wherever you are. This focus on simple ways to get and keep your vehicle protected is, in a way, what they are about.

Table of Contents

- What makes Dairyland Auto Insurance a good choice?

- How does Dairyland Auto Insurance help you save money?

- Is getting a Dairyland Auto Insurance quote easy?

- Dairyland Auto Insurance - Beyond the Basics

- What kind of protection does Dairyland Auto Insurance offer?

- Dairyland Auto Insurance - Understanding Costs

- Dairyland Auto Insurance - Your Partner on the Road

- Dairyland Auto Insurance - A Good Fit for You?

What makes Dairyland Auto Insurance a good choice?

Many folks, you know, want to feel like they are putting their trust in a company that has been around a bit. Dairyland has been a name people have trusted for their vehicle protection for a very long time, over 50 years, as a matter of fact. That kind of history suggests a certain level of experience and commitment to helping people stay covered on the road. It means they have seen a lot of things and probably learned a lot about what drivers need over those decades. This long standing presence in the protection space is, in some respects, a sign of their reliability.

When you are looking for vehicle protection, you usually want choices, right? Dairyland offers a selection of ways to cover your car. This means you can pick and choose what makes the most sense for your situation, which is pretty helpful. They also have ways to help you save some money, like different kinds of discounts. These options and discounts are there to help you find the right fit for your needs without feeling like you are paying too much. It’s about getting what you need at a price you can actually pay, which is usually a big concern for people.

The idea of finding protection that you can actually pay for is a big one for most people, naturally. Dairyland works to offer options that are affordable. They want you to be able to get the vehicle protection you need without it being a financial burden. This focus on being budget friendly, while still giving you the protection you expect, is a key part of what they do. They try to make sure that getting covered is something that is within reach for many different kinds of budgets, making it, you know, more accessible.

How does Dairyland Auto Insurance help you save money?

One of the ways Dairyland tries to help you keep your costs down is through various discounts. These aren't just random price cuts; they are ways to recognize certain things that might make you eligible for a lower rate. While we cannot get into the specific details of every single discount, the idea is that by meeting certain conditions, you could see your overall cost go down. This can be a really good way to make your Dairyland auto insurance more affordable without giving up the important protection you need. It’s like finding little ways to trim your expenses, which is always nice.

Many people worry that if something is cheap, it might not be very good. Dairyland, however, aims to offer what they call "cheap car insurance" without making you feel like you are getting less quality. They try to balance being easy on your wallet with providing the kind of protection that actually helps you when you need it. This means they are working to give you a good value, where the cost is low, but the benefits are still there. It's about getting a good deal that still gives you peace of mind, basically.

A really simple way to find out if Dairyland can help you save is to just ask for a free estimate. It costs you nothing to get a price, and you can see for yourself what kind of rates they offer. This quick check can show you if their prices are a good fit for your budget and if you might be able to lower what you are currently paying. It’s a straightforward step that can potentially lead to some savings for your Dairyland auto insurance, which is definitely something worth looking into, right?

Is getting a Dairyland Auto Insurance quote easy?

When you are thinking about getting vehicle protection, you probably want the process to be as simple as possible. Dairyland aims to make getting a price estimate quick and free, whether you prefer to do it online or by talking to someone on the phone. This means you don't have to wait around or go through a lot of steps just to get an idea of what your Dairyland auto insurance might cost. It's about getting you the information you need in a way that fits your schedule, which is pretty convenient for most people, I mean.

For instance, if you happen to live in South Carolina and are looking for car protection, Dairyland offers free price estimates specifically for that area. This shows that they are set up to help drivers in various places get a sense of their costs quickly. The ability to get a specific estimate for your location means the prices you see are more likely to be relevant to your actual situation. It’s like they have their systems ready to give you local information, which is quite helpful.

The whole process of getting an estimate with Dairyland is set up to be free, simple, and secure. You won't be charged just for asking for a price, and the steps are usually straightforward, so you don't get lost in a lot of confusing forms. Plus, they work to keep your personal information safe during the process. This focus on ease and safety means you can feel good about getting an estimate and seeing what Dairyland auto insurance might offer you, just a little bit more comfortably.

Dairyland Auto Insurance - Beyond the Basics

Managing your payments for vehicle protection should be easy, and Dairyland seems to understand this. They offer flexible ways to pay your bill, so you can often choose what works best for your budget and schedule. This means you can pay your Dairyland auto insurance bill anytime and from anywhere, which is really handy if you have a busy life. Having choices for how and when you pay can make a big difference in how smoothly things run, basically.

If you ever have questions about your payments, a claim you have made, or anything about your protection plan, Dairyland has customer service ready to help. You can get details on their various ways to help you with these things. This support means you are not left on your own if something comes up or if you just need some clarity about your Dairyland auto insurance. It's like having a helpful hand there when you need it, which is, you know, a good thing.

Dairyland is based in Wisconsin, but they offer car protection across the entire country, in all 50 states. This wide reach means that no matter where you are driving, chances are Dairyland can offer you some kind of vehicle protection. This broad availability is a pretty big deal for a company that has been around for so long. It shows their commitment to serving drivers all over the United States, which is, in a way, impressive.

For those who like to compare options from different companies, you can also look into Dairyland car protection and Dairyland motorcycle protection through a service called SelectQuote. This gives you another way to explore what Dairyland has to offer alongside other providers. It’s like having another door to walk through to see if their options are a good fit for you. This kind of access makes it easier to shop around and find what you need, honestly.

What kind of protection does Dairyland Auto Insurance offer?

When you get vehicle protection, the main idea is to get some financial help if something unexpected happens. Dairyland auto insurance aims to provide this kind of support. This usually means getting financial protection against things like physical damage to your vehicle or injuries to people. It’s about having a safety net so that if you are in an accident, or if your vehicle gets damaged, you have some help covering the costs. This can really take a lot of worry off your shoulders, you know, when you are out on the road.

The financial protection that Dairyland offers can cover various situations that might come up when you are driving. For instance, if your car gets dinged up in a collision, or if someone gets hurt, having this protection means you might not have to pay for everything out of your own pocket. It’s there to help with the bills that can pile up after an incident. This kind of help is, in a way, the core purpose of having vehicle protection, to keep you from facing huge costs on your own, apparently.

So, when Dairyland talks about protection, they are thinking about those moments where you really need some backup. It’s not just about meeting a legal requirement; it's about having a plan for when things go wrong. This kind of financial support helps you get back on your feet faster after an incident, whether it involves your vehicle or another person. It’s a pretty important part of being a responsible driver, and Dairyland aims to provide that support, basically.

Dairyland Auto Insurance - Understanding Costs

When considering Dairyland auto insurance, it’s helpful to have an idea of what other people might be paying. The average yearly cost for their car protection is around $3,537. Now, this is just an average, so it’s like a middle point. Some people might pay less, and some might pay more, depending on their own specific situation. This number gives you a general idea, but it’s not what everyone will pay, obviously.

The actual cost for Dairyland auto insurance can vary quite a bit. You might pay as little as $1,560 in a year, or it could go up to as much as $4,008 annually. This wide range shows that many things can affect your specific price, like where you live, what kind of car you drive, and your driving history. So, while there is an average, your own price will fall somewhere within this range, depending on your personal details, which is quite common with vehicle protection.

It is true that this yearly average for Dairyland auto insurance might appear higher than some other averages you might see out there. However, it is important to remember that prices are influenced by many factors. Even with a potentially higher average, Dairyland is still seen as a choice for drivers who need flexible and affordable protection. The overall value often comes from the specific options and benefits you get, not just the base number, you know, in a way.

Dairyland Auto Insurance - Your Partner on the Road

Whether you prefer the open road on a motorcycle or the comfort of a car, Dairyland aims to be there for you. They offer protection for both two-wheeled and four-wheeled vehicles. This means they are ready to support you no matter what kind of ride you have. It’s like having a companion for your travels, making sure you have some backup, which is pretty reassuring for many drivers, too it's almost.

Their goal is to help you keep your vehicle, whether it’s a car or a bike, and yourself on a good path. This means providing the kind of vehicle protection that gives you confidence when you are out driving. It’s about more than just a piece of paper; it’s about having a sense of security so you can focus on your trip. This support for your travels is, in a way, what Dairyland tries to offer every day.

Being a partner on the road means being there when things are going well and when they are not. Dairyland auto insurance aims to be that consistent presence. They want to make sure that you feel supported in your driving life, whether you are commuting to work or taking a long trip. This commitment to being there for drivers, no matter what they drive, is a big part of their approach, which is rather nice.

Dairyland Auto Insurance - A Good Fit for You?

Dairyland auto insurance is often considered a good choice for drivers who are looking for certain qualities in their protection. If you need something that is flexible, meaning it can adjust to your needs, then Dairyland might be worth a look. This flexibility can mean different payment options or various coverage choices, which is very helpful for many people trying to manage their finances, you know.

Affordability is another key point for many drivers, and Dairyland tries to meet that need. They work to offer prices that are within reach for a lot of budgets, without making you feel like you are getting a lesser product. The goal is to provide good value, where you get the protection you need at a price that makes sense for your wallet. This balance of cost and quality is, in some respects, what many drivers are searching for.

Finally, if you are looking for protection that is comprehensive, meaning it covers a wide range of situations, Dairyland aims to provide that too. This kind of protection tries to give you broad coverage so you are ready for different kinds of incidents that might happen on the road. When you put flexibility, affordability, and comprehensive coverage together, Dairyland auto insurance could be a solid option for many drivers looking for a reliable plan, basically.

- Bella Boutique

- The Sharpest Rides Car Dealer

- Culvers Flavor Of The Day Near Me

- Rad Swim

- Puesto Mission Valley

Dairyland Auto Insurance Review for 2025 (Rates, Discounts, & Options

Dairyland Auto Insurance Review for 2025 (Rates, Discounts, & Options

Dairyland Auto Insurance Review for 2025 (Rates, Discounts, & Options